CreditDIY - Credit Repair Made Easy

Fair

Last Score 496

Good

Last Score 509

Excellent

Last Score 515

About Us

Strengthen your financial foundation with ease using CreditDIY’s streamlined services. Our platform is designed to give you full command of your financial future, offering a logical and straightforward approach. Say goodbye to unnecessary delays and complications, CreditDIY provides a smooth, guided path to enhancing your credit online. Best of all, you set the pace, managing every step independently without relying on others. This is more than just credit repair - it’s your opportunity to feel DIY credit freedom.

Getting started is hassle-free and remains simple. For a one-time fee of $299, followed by $59 monthly, you unlock access with no hidden costs or fine print. Many users begin noticing credit score improvements within a few cycles. Behind the scenes, CreditDIY automatically identifies and challenges negative items, using smart logic to protect your active accounts, ensuring your credit history and payment record remain intact.

Our credit repair goes beyond the basics – we thoroughly examine your credit report, addressing old addresses, outdated details, and unnecessary inquiries, as well as persistent negatives like charge-offs, repossessions and foreclosures. CreditDIY helps you clear the clutter and maintain a credit report that supports your long-term financial health.

We're Not Like The Others

Take Charge Of Your Credit Score

Take full ownership of your credit improvement journey with CreditDIY. Our online service allows you to oversee your credit directly, free from delays caused by intermediaries. Experience a clear and uncomplicated process that guides you through each stage, providing you with essential tools and innovative technology to enhance your credit and pave the way for a more secure financial outlook.

From Negative to Noteworthy

A lower credit rating can restrict your financial possibilities, but CreditDIY’s advanced approach changes that. Our system swiftly identifies errors such as duplicates or outdated data and creates best dispute documents. With a straightforward process and continuous credit bureau updates, you maintain control, making credit improvement both effective and manageable for a brighter financial future.

Keep Accounts

Maintaining active accounts safeguards your credit history, which is key to a consistent credit rating. With CreditDIY, paid-as-agreed accounts remain on your report without impacting your score, supporting long-term credit stability. Our platform carefully assesses negative entries and preserves active accounts, fostering trust with credit bureaus and enhancing your overall credit standing.

We’ve Got You Covered

At every stage, CreditDIY’s committed support team assists you through your credit journey. Utilizing sophisticated features like automated dispute handling, we provide customized solutions for your specific credit needs. Whether addressing report inaccuracies or elevating your score, CreditDIY equips you with effective strategies and modern tools to take charge and strengthen your financial foundation.

How Our Advanced Credit Repair System Works?

Achieve better credit with CreditDIY’s online credit repair services.

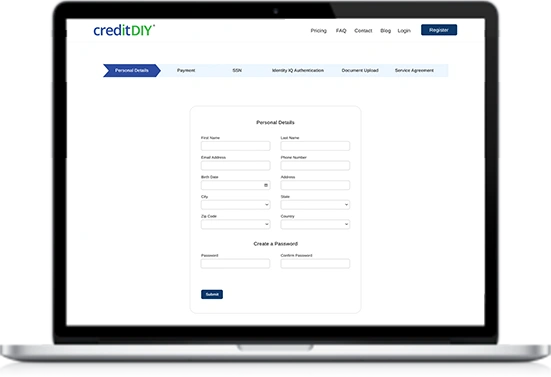

Start by entering your basic information—name, phone number, email, and location. This helps us personalize your experience and prepare your dashboard. With just a few details, you’re already on your way to better credit, and the setup takes less than a minute to complete.

Register Now!

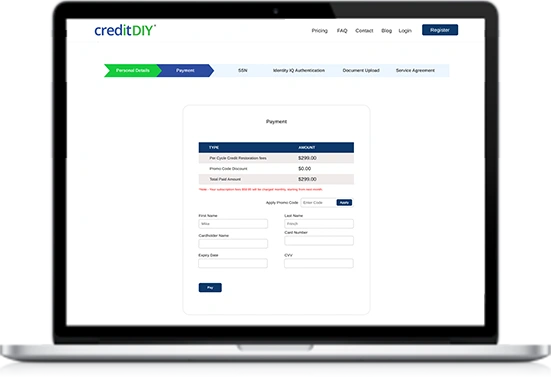

Pay a one-time subscription fee of $299, along with a $59 charge for each monthly repair cycle. This gives you full access to CreditDIY’s AI tools, dispute generator, and real-time bureau syncing—everything you need to fix your credit on your terms, with no surprise costs along the way.

Register Now!

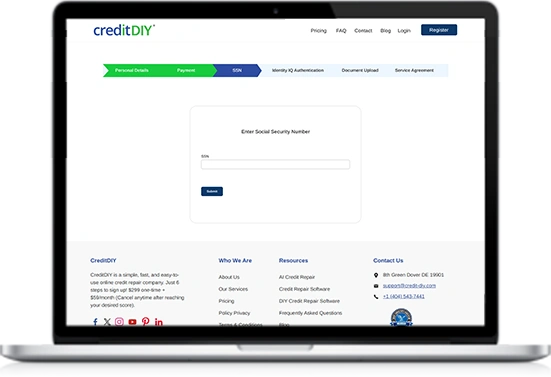

Your 9-digit Social Security Number is essential to securely verify your identity with all three major credit bureaus. This step ensures accurate syncing of your credit report, allowing the system to analyze data, find errors, and begin the dispute process without delays or mismatches in information.

Register Now!

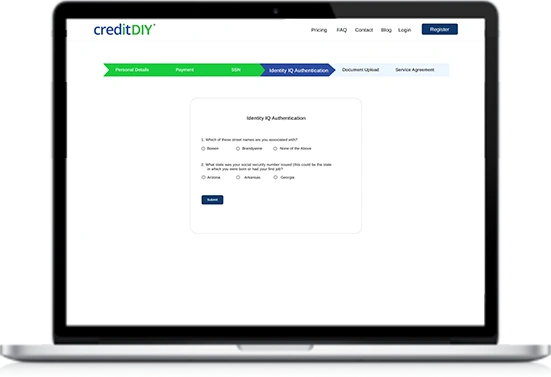

For your protection, we’ll walk you through a simple but secure identity verification step. This keeps your data safe and prevents unauthorized access to your credit repair process. Once authenticated, the software begins syncing with Experian, TransUnion, and Equifax to pull real-time data directly from your credit reports.

Register Now!

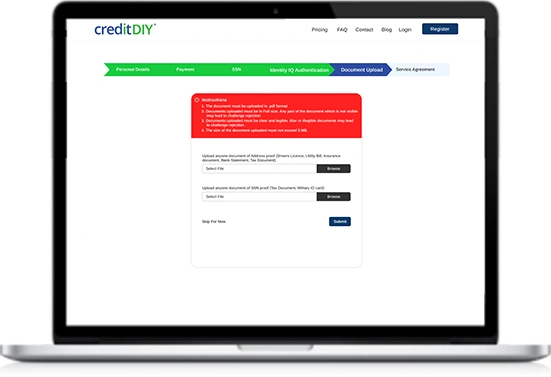

Strengthen your disputes by uploading key documents like billing statements, ID proof, or payment receipts. These files are stored with bank-level encryption and linked to specific dispute claims, helping ensure accuracy, compliance, and a higher chance of successful outcomes during the credit repair process.

Register Now!

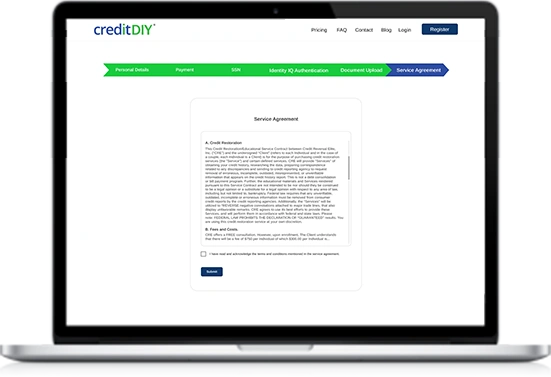

Review and agree to our service terms to activate your account. This final step unlocks your dashboard, dispute tools, and progress tracker. You’re now ready to begin fixing your credit score with complete transparency, full control, and professional-grade tools—all in your hands.

Register Now!Upgrade Your Financial Future with CreditDIY

Take the reins of your financial journey with CreditDIY, a personalized credit repair solution crafted for those aiming to address credit challenges independently. Our platform equips you with innovative tools and a straightforward approach, eliminating complexity and guesswork.

Our online credit repair service includes automated dispute creation, producing fitted letters directly from your credit report. CreditDIY’s dashboard connects with all three major bureaus – Experian, TransUnion, and Equifax – to track changes in real time. With AI-driven support, outdated data, duplicate entries and unverifiable debts are seamlessly removed from your credit profile.

Our intelligent prioritization system focuses on the most impactful items first for faster outcomes, while account preservation ensures your positive credit history remains intact. Use the progress tracker dashboard to view dispute updates, score trends, and more at a glance. We utilize top-tier encryption for complete security and provide adaptable letter templates aligned with FCRA standards.

Whether you’re starting fresh or maintaining your credit, CreditDIY offers clear insight with no confusing terms – just tangible results. Begin today and discover the simplest, most effective way to manage your credit.

Pricing

- Sign Up In 6 Easy Steps

- Cancel Any Time

- Credit Score Analysis

- Online Support

- Minimum Documentation Required

- Challenges to 3 Credit Bureaus

- Credit Report Update Time 30 to 45 days